Curlec by Razorpay to offer easier real time payments in Malaysia via DuitNow

Seeing the rise in digital payments by Malaysians, Curlec by Razorpay, a full-stack payments solution provider has officially announced that they are now adopting the DuitNow product suite by PayNet, allowing merchants of all sizes in Malaysia to enjoy more seamless and efficient collections via their Curlec Payment Gateway solution.

This momentous accord and membership in PayNet enables Curlec by Razorpay to leverage technologies from the Razorpay Group and their expertise in real-time payments from India’s Unified Payment Interface (UPI) which saw over 74 billion transactions in 2022; to wit currently the world’s largest market for digital payments in order to better serve the Malaysia market.

What is Curlec by Razorpay

For the uninitiated, Curlec by Razorpay was founded in Malaysia in 2018 and was acquired by India-based Razorpay in 2022 while PayNet, formerly known as the Malaysian Electronic Clearing Corporation Sdn Bhd is Malaysia’s premier payments network and central infrastructure for the financial market, with eleven Malaysian banks as shareholders and Bank Negara Malaysia (BNM) as the largest shareholder.

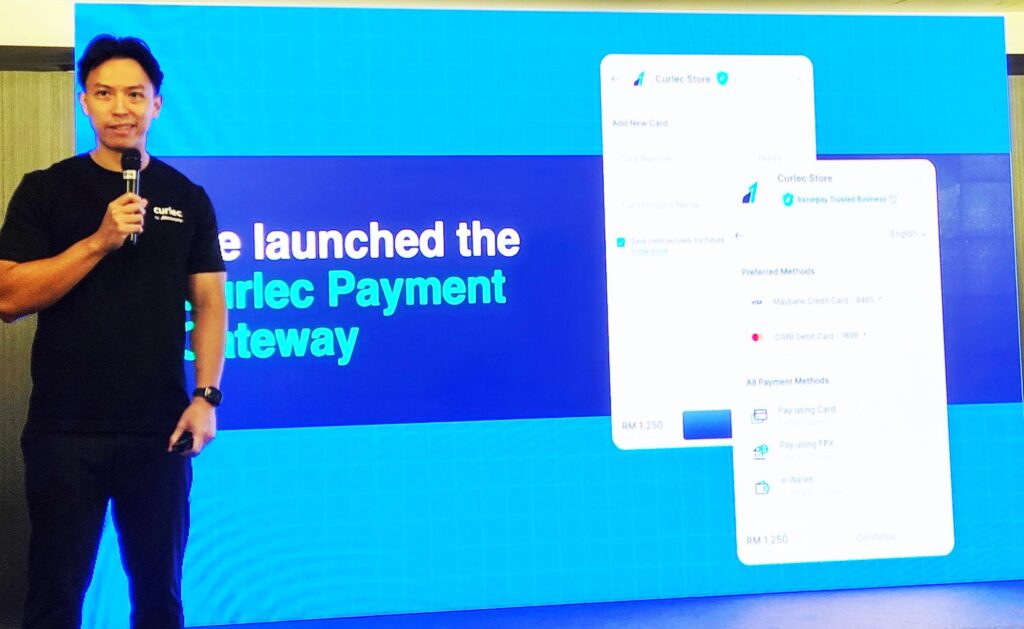

Zac Liew, cofounder and Chief Executive Officer of Curlec by Razorpay

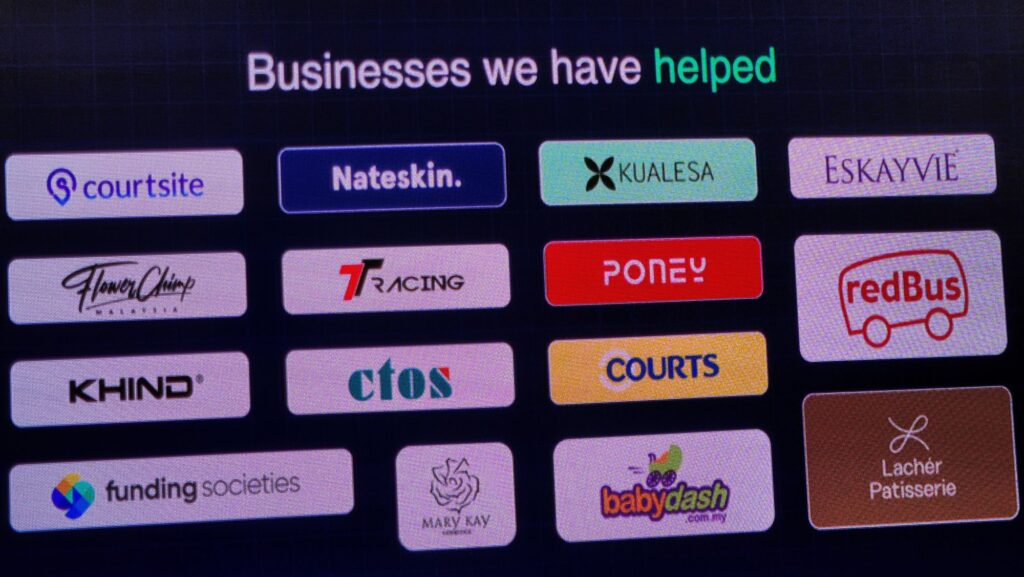

Leveraging their intimate understanding of Malaysia’s payments ecosystem and Razorpay’s technologies, the Curlec Payment Gateway payment solution is regulated by Bank Negara Malaysia (BNM), offers simplified API integration, automation features and a streamlined onboarding process to make collections from customers both efficient and easy in equal measure for merchants of all sizes. To date, the Curlec Payment Gateway solution is used by over 1,000 businesses in Malaysia including Tune Protect, CTOS, Mary Kay and the National Kidney Foundation.

“Malaysia continues to take steps through its financial blueprint towards a cashless society with the aim of e-payment per capita increasing at over a 15% CAGR by 2026. The target growth of Malaysia’s digital payments sets the path for The Curley Payment Gateway’s target to serve more than 5,000 businesses with RM10 billion annualised gross transaction value (GTV) by 2025,” says Zac Liew, cofounder and Chief Executive Officer of Curlec by Razorpay.

Gary Yeoh, Chief Commercial Officer, PayNet said, ”Malaysia’s financial sector blueprint seeks to futureproof key digital infrastructure to enable more digital finance solutions, and Curlec’s Payment Gateway is a welcome addition to our moment in the blueprint. Digital transactions per capital have more than quadrupled, hiking from 49 in 2011 to over 221 in 2022. With the expectation that the number will reach over 400 by 2026, Curlec’s adoption of DuitNow is another ship listed on the rising tide of digital payments” For more details or Curlec by Razorpay, check out their official page at https://curlec.com/